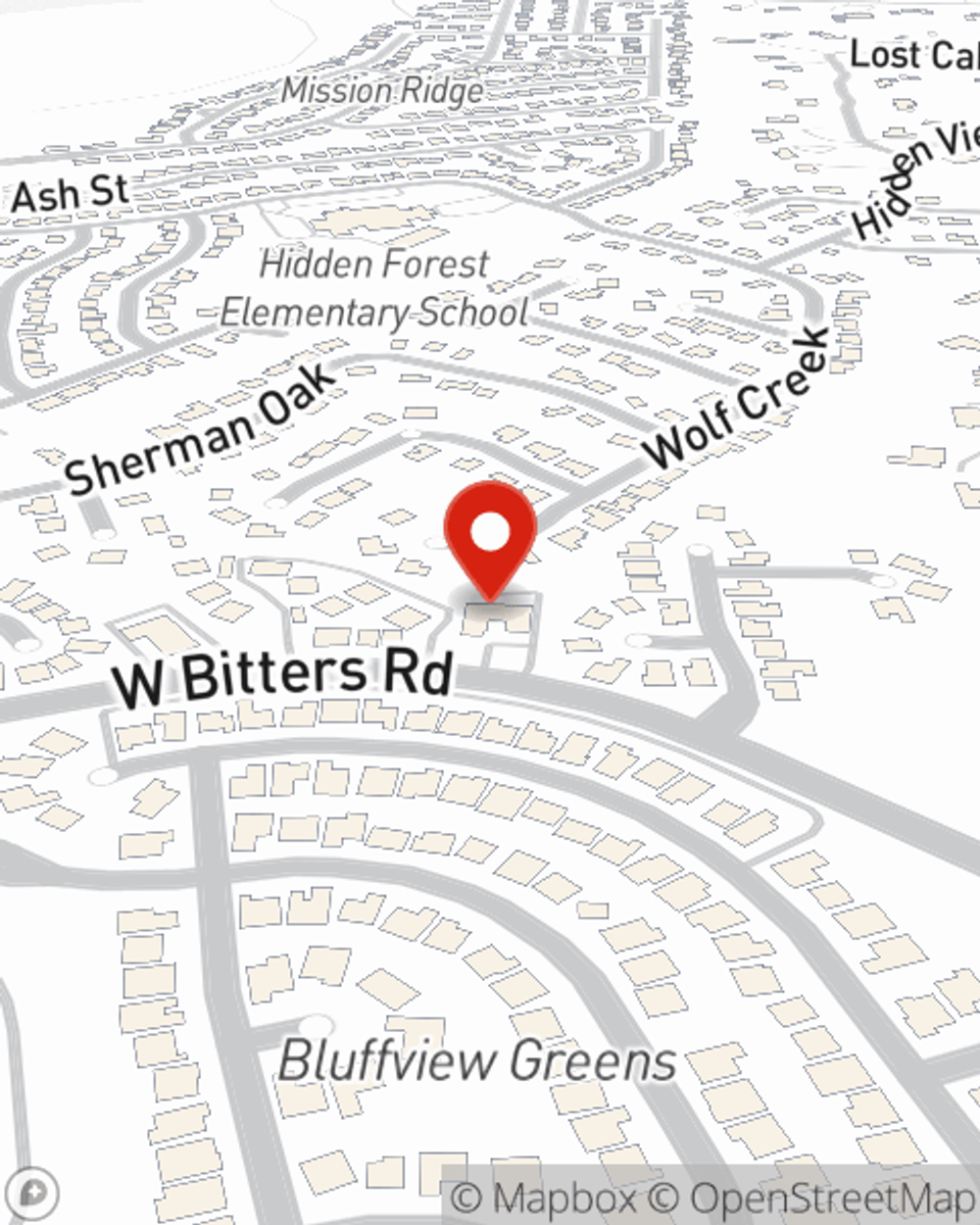

Business Insurance in and around San Antonio

Looking for small business insurance coverage?

Cover all the bases for your small business

State Farm Understands Small Businesses.

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent John Pitre. John Pitre can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Looking for small business insurance coverage?

Cover all the bases for your small business

Get Down To Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your salary, but also helps with regular payroll costs. You can also include liability, which is crucial coverage protecting you in the event of a claim or judgment against you by a consumer.

Get in touch with the outstanding team at agent John Pitre's office to explore the options that may be right for you and your small business.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

John Pitre

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.