Condo Insurance in and around San Antonio

Condo unitowners of San Antonio, State Farm has you covered.

Cover your home, wisely

Your Belongings Need Insurance—and So Does Your Condo Unit.

When considering different providers, coverage options, and deductibles for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo but also your personal belongings within, including electronics, cookware, shoes, and more.

Condo unitowners of San Antonio, State Farm has you covered.

Cover your home, wisely

Condo Unitowners Insurance You Can Count On

When a hailstorm, a windstorm or a blizzard cause unexpected damage to your unit or someone hurts themselves in your home, having the right coverage is significant. That's why State Farm offers such excellent condo unitowners insurance.

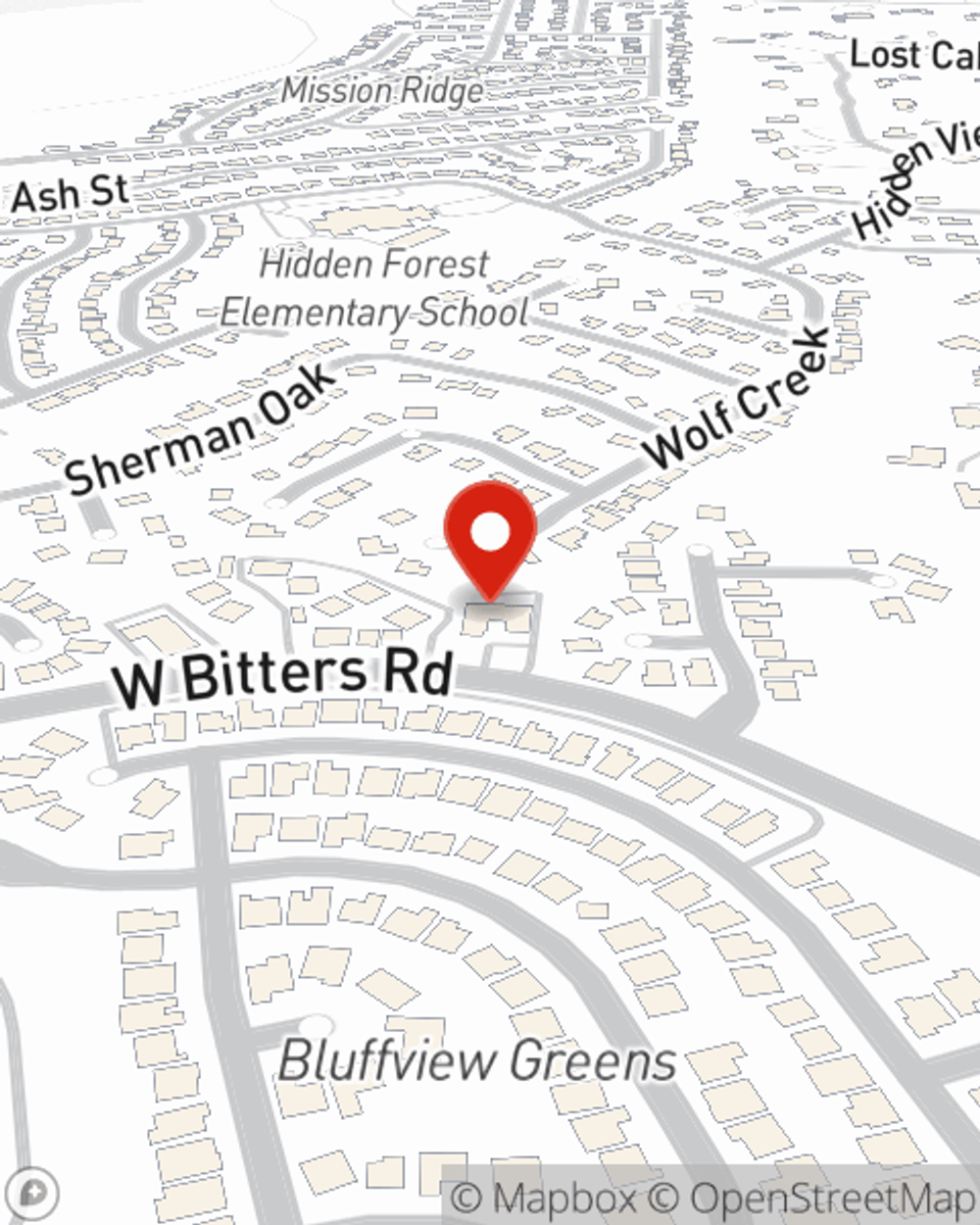

There is no better time than the present to visit agent John Pitre and learn about your condo unitowners insurance options. John Pitre would love to help you make sure your bases are covered.

Have More Questions About Condo Unitowners Insurance?

Call John at (210) 514-1083 or visit our FAQ page.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Simple Insights®

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.